Dogecoin (DOGE) price has been on a wild ride, up 180% in the last month but down 7.03% over the past seven days. As the undisputed leader of meme coins, DOGE boasts a massive $58 billion market cap, four times larger than its closest competitor, SHIB, at $14.5 billion.

While recent price action has highlighted DOGE’s dominance, indicators like the Ichimoku Cloud and DMI suggest its bullish momentum might be losing steam. Whether DOGE can sustain its rally or face a deeper correction will depend on how the current trend evolves in the coming days.

DOGE Ichimoku Cloud Shows a Bullish Zone

DOGE is currently trading above the Ichimoku Cloud, which is considered a bullish signal. The price is also supported by the Tenkan-sen (blue line) and Kijun-sen (red line), both trending upward, indicating strong short-term and medium-term momentum.

However, the narrowing gap between these lines suggests a potential slowdown in bullish momentum, hinting at caution for further price increases.

The cloud (Kumo) ahead is green, signaling that DOGE’s trend remains positive in the near future. However, with price movements consolidating near the top of the cloud, there is a risk of a potential retracement if DOGE fails to break above recent highs.

A drop below the Kijun-sen or into the cloud could indicate a weakening trend and a shift toward a bearish sentiment. For now, DOGE holders may watch closely for sustained momentum above the Tenkan-sen to maintain the uptrend.

Dogecoin Uptrend Isn’t That Strong Right Now

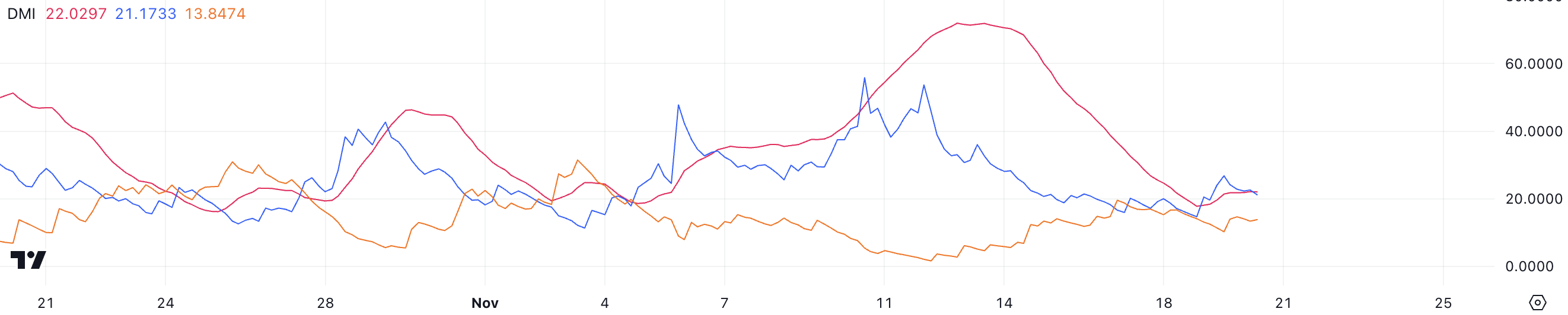

Dogecoin Directional Movement Index (DMI) chart shows its ADX at 22, significantly down from over 60 just a week ago. While DOGE remains in an uptrend, the falling ADX indicates that the trend’s strength is weakening, suggesting a possible slowdown in bullish momentum.

This decline aligns with other signals pointing to a more cautious outlook for DOGE’s price in the short term.

The ADX measures the strength of a trend, with values above 25 signaling a strong trend and values below 20 indicating a weak or nonexistent trend. DOGE’s D+ is at 21.17, representing bullish pressure, while D- is at 13.84, reflecting bearish pressure.

However, D+ has been decreasing while D- is rising, suggesting that bullish momentum is fading, and bearish sentiment is slowly gaining traction. With ADX at 22, DOGE’s current trend is losing steam, signaling the need for a stronger catalyst to sustain its upward trajectory.

DOGE Price Prediction: Biggest Price Since 2021?

DOGE price could see further upside if it tests and breaks the resistance at $0.438. Successfully moving past this level could pave the way for a rally toward $0.50, marking its highest price since 2021. This would send DOGE’s market cap above $60 billion, bigger than companies like Porsche and Mercedes-Benz. This could drive a new surge in the meme coins narrative.

This scenario would indicate renewed bullish momentum and strong buyer interest.

However, as indicated by the DMI, DOGE’s current trend may be losing strength, raising concerns about a potential reversal. If bearish momentum takes over, DOGE price could test its nearest support at $0.34.

Should this level fail, the price could retrace significantly, potentially dropping to $0.14, representing a steep 64% correction from current levels.

The post Dogecoin (DOGE) Market Cap Could Surpass Porsche and Mercedes-Benz If This Happens appeared first on BeInCrypto.