- Simplified crypto rules align with securities law, supporting clarity and fostering innovation.

- Decentralization metrics in token regulation create vagueness, risking legal inconsistency.

- FIT21 revisions can enhance enforcement by removing decentralization as a defining criterion.

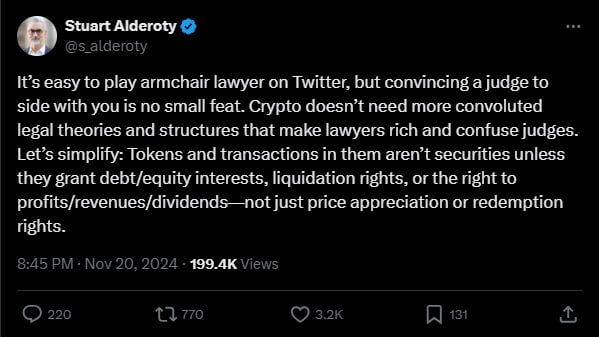

Crypto tokens classified as securities have been a hot-button issue within the digital asset space. Instead, Stuart Alderoty, Chief Legal Officer at Ripple, advocates for a simplified approach to crypto regulation. He asserts that only tokens with equity or profit rights should be classified as securities. This approach can, he says, reduce legal ambiguity.

Alderoty believes this targeted approach would better align with established securities law and offer clarity for all parties involved.

These cases occur when tokens embody financial rights like equity, debt interests, or entitlements to profits or liquidation proceeds. Simplifying these criteria reduces legal ambiguity and supports innovation without unnecessary legal entanglements.

Reassessing Decentralization as a Defining Metric

Further noted by MetaLawMan, crypto regulation often suffers from an over-reliance o…

The post Ripple CLO: Only Specific Tokens Should Be “Securities” appeared first on Coin Edition.